Unlocking the Mysteries of Payroll: A Guide to Definition, Processes, and Solutions

Payroll processing is a critical but complex task that is essential to the smooth operation of any business. While large enterprises have dedicated teams to handle this task, small and medium-sized enterprises (SMEs) often struggle with processing payroll due to their limited resources. SMEs typically resort to using spreadsheets or outsourcing to professionals, both of which can be error-prone. This can result in delayed payments, inaccuracies in tax calculations, and even legal issues. Therefore, SMEs should explore modern payroll solutions that can streamline the payroll process and minimize the risk of errors, allowing them to focus on growing their business.

Are you tired of the stress and headaches that come with managing your company's payroll? Payroll mistakes can happen faster than you think, and the consequences can be severe. Employees depend on their monthly salary as their only source of income, and any inaccuracies or delays can have a detrimental effect on their morale and productivity, ultimately affecting your business as a whole.

That's where Team Suite comes in. Our cutting-edge payroll software is designed to streamline the payroll process, ensuring accuracy and efficiency every step of the way. With Team Suite, you can say goodbye to manual data entry and complex spreadsheets, and hello to a modern, user-friendly interface that simplifies the entire payroll process.

Our software allows you to easily manage employee data, automate tax compliance, and process payroll with ease, regardless of your company's size or complexity. Plus, with our customizable payroll cycles and real-time reporting, you'll have complete visibility and control over your payroll operations.

Don't let payroll mistakes bring down your business. Upgrade to Team Suite today and experience the benefits of hassle-free payroll management.

Ensure Payroll Compliance with Regulatory Requirements.

Modern technology has revolutionized payroll management, enabling businesses to streamline the payroll process and improve accuracy. By adopting advanced payroll software like Team Suite, businesses can simplify the payroll process and ensure compliance with regulatory requirements.

What is Payroll

Payroll is defined as the process of paying salary to a company’s employees. It starts with preparing a list of employees to be paid and ends with recording those expenses.

It’s a tangled process that needs different teams such as payroll, HR and finance to work together. But, businesses can manage all the complexities effortlessly by choosing modern technology.

A payroll cycle is the time gap between two salary disbursements. Businesses can opt to pay salaries on a weekly, bi-weekly, or monthly basis. Generally, it is processed every month in Pakistan.

Payroll Terms

1. Gross Pay: Gross salary is the total of all the components of the salary package offered to an employee. It is the salary before any mandatory and voluntary deductions such as income tax, provident fund, medical insurance, etc.

2. Net Pay: After calculating gross pay, you have to make govt. mandated deductions such as income tax, provident fund, etc. from gross pay. The amount that an employee takes home after all such deductions is termed net pay or net salary.

3. Overtime: Overtime refers to the extra hours worked by an employee in a company than the usual defined as per govt. Law. The extra salary or remuneration depends that the employee will get depends on the company policies.

4. Pay Period: It is a time frame defined to calculate earned wages and determine when employees receive their payslips. Pay periods are fixed and recurring on a bi-weekly, or monthly basis.

5. Compensation: It involves managing, analysing, and determining the salary, benefits, and incentives paid to the employees for their work.

6. Contractual employees: These are not permanent employees and are usually employed on a temporary basis. Their terms of employment are mentioned in a contract.

What are the Stages to Processing Payroll?

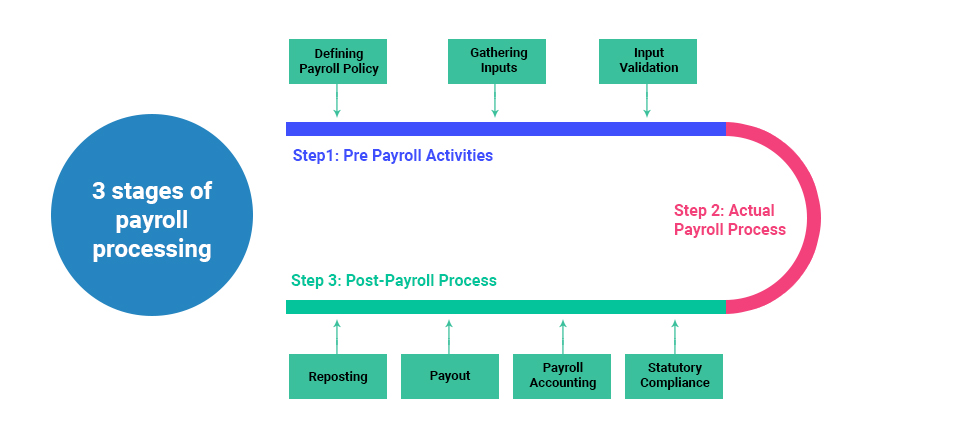

A payroll officer needs to do careful planning. There are always ongoing tasks that need attention and a constant need to monitor changes to withholdings, contribution to social security funds, etc. The entire process can be split into three stages, pre-payroll, actual payroll and post payroll activities.

Pre-Payroll Activities

Defining Payroll Policy

The net amount to be paid is affected by multiple factors. The company's various policies such as pay policy, leave and benefits policy, attendance policy, etc. come into play at that time. As a first step, such policies need to be well defined and get approved by the management to ensure standard payroll processing.

Gathering Inputs

Payroll process involves interacting with multiple departments and personnel. There can be information like mid-year salary revision data, attendance data, etc.

In smaller organizations, these inputs are received from a consolidated source or fewer teams. However, in a larger organization, the task of gathering data may look overwhelming. If you are using a smart payroll system having integrated features like leave and attendance management, employee self-service portal, etc. inputs collection process does not remain a problem.

Input Validation

Once inputs are received, you need to check for validity of the data concerning adherence to company policy, authorization/approval matrix, right formats, etc. You also need to ensure that no active employee is missed out and that no inactive employee records are included for salary payment.

Actual Payroll Process

Payroll Calculation

At this stage, the validated input data is fed into the payroll system for actual payroll processing. The result is the net pay after adjusting necessary taxes and other deductions. Once payroll process is over, it is always a good practice to reconcile the values and verify for accuracy to avoid any errors.

Post-Payroll Process

Statutory Compliance

All statutory deductions like EPF, TDS, ESI are deducted at the time of processing payroll. The company then remits the amount to the respective government agencies. The frequency can vary depending on the type of the dues. In most cases, payment of dues is made via challans. After all dues are paid return/report are filed. E.g., for filing PF return, ECR is generated and filed.

Payroll Accounting

Every organization keeps a record of all its financial transactions. Salary paid is one of the significant operating costs which has to be reported in the books of accounts. As part of payroll management, it is essential to check that all salary and reimbursement data is fed accurately into accounting/ERP system.

Payout

You can pay salary by cash, cheque or bank transfer. Typically organizations provide employees with salary bank account. Once you complete payroll, you need to ensure that company’s bank account has sufficient funds to make the salary payment. Then you need to send a salary bank advice statement to the concerned branch. This statement is issued with particulars like employee id, bank account number, amount of wages, etc. If you are opting for a payroll management software that has employee self-service portal, you can easily publish the payslips and employees can log-in to their account and access the payslips.

Reporting

Once you complete payroll run for a particular month, finance and high management team may ask for reports such as department wise employee cost, location wise employee cost, etc. As a payroll officer, it becomes your responsibility to dig into the data and extract required information and share the reports.

Statutory Compliance in Pakistan Payroll

When you run payroll, being statutory compliant means that you are paying as per the applicable employment norms set by the central and state legislation. The common statutory requirements that apply to Pakistan businesses include the provision for minimum wages, payment of overtime wages to workers, TDS deduction, contribution to social security schemes such as PF, ESI, etc.

While computing salary you need to consider all these deductions and contributions. Income tax is one such deduction. At the beginning of the year, the employee is asked to make a declaration about his additional incomes, tax saving investments, etc. called as ‘income tax declaration.’ Accordingly, employee’s tax liability is calculated, and TDS is deducted.

Let’s see how to calculate tax for any individual. In Pakistan, we have four tax brackets with an increasing tax rate.

Based on above tax slabs, you can calculate monthly tax liability and deduct TDS. The TDS is then deposited monthly with the government, and a quarterly report of all deductions is also filed. Once you complete TDS returns for the fourth quarter, you can issue form 16 to employees. The employees use this form 16 as proof of tax deducted at the time of filing their individual income tax return.

Non-adherence with the statutory law can lead to hefty fines and penalties. That is why you need to be up to date on all tax and payroll statutory changes.

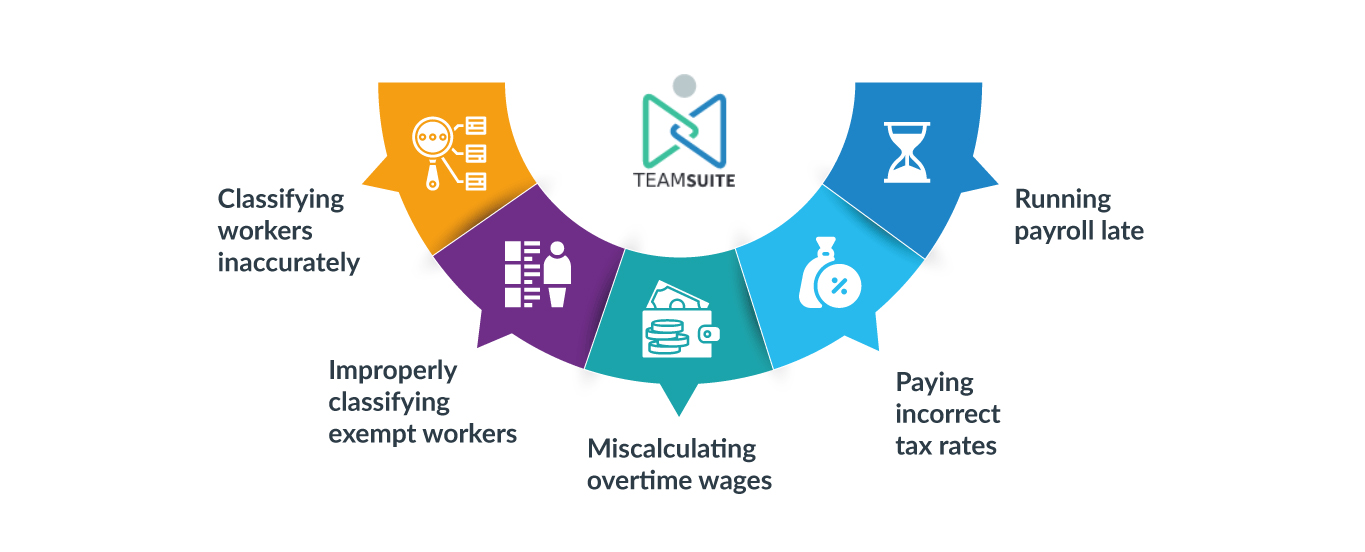

Challenges in Handling Payroll Management Process

The payroll process becomes challenging due to two main reasons.

The Requirement to stay Statutory CompliantAs mentioned before, non-adherence to statutory laws can lead to levy of fines and penalties and in the worst case may even threaten the existence of the business. Today there are some advanced payroll management software that automatically processes payroll in compliance with statutory laws.

Before payroll can be processed, you need to get all the data together from sources such as attendance register, conveyance facility availed record, data from HR team like salary revision information, etc., making it a complicated process. For many years HR and payroll officers were managing payroll on excel sheets, but excel sheets have problems like dependency on excel formulas for salary calculation, complexity in adding and removing employees and other limitations like manual data entry, difficulty in extracting information, etc.

Various Methods Available to do Payroll for your Business

The possible options for running payroll can be

- Excel based payroll management

- Payroll outsourcing

- Using payroll software

Excel based Payroll Management

Many businesses who are at an initial stage of operations and have a handful of employees usually go for excel based payroll management.

Excel based payroll management involves doing payroll calculation on excel sheets using standard payroll calculation template. The mathematical formulas are set that help the payroll officer do the computation. While this method does not involve any cost, but it has its inherent limitations like

- High chances of clerical and mathematical errors as data is entered manually

- Difficulty in adding and removing employees from payroll list

- Chances of duplicate data and omission of entries at times

- Need to monitor tax updates and other statutory changes like PF, PT etc

Payroll Outsourcing

Outsourcing payroll means you want an external agency to take care of your payroll function. Many organizations who do not have a dedicated person for payroll go for this option. Based on their pay cycle, every month they provide employee salary information and other data such as attendance, leaves, reimbursement details, etc. to the payroll service provider. The service provider then computes payroll and also takes care of statutory compliance. Since payroll is a crucial function and businesses want to have full transparency and control over it, they often hesitate in outsourcing payroll.

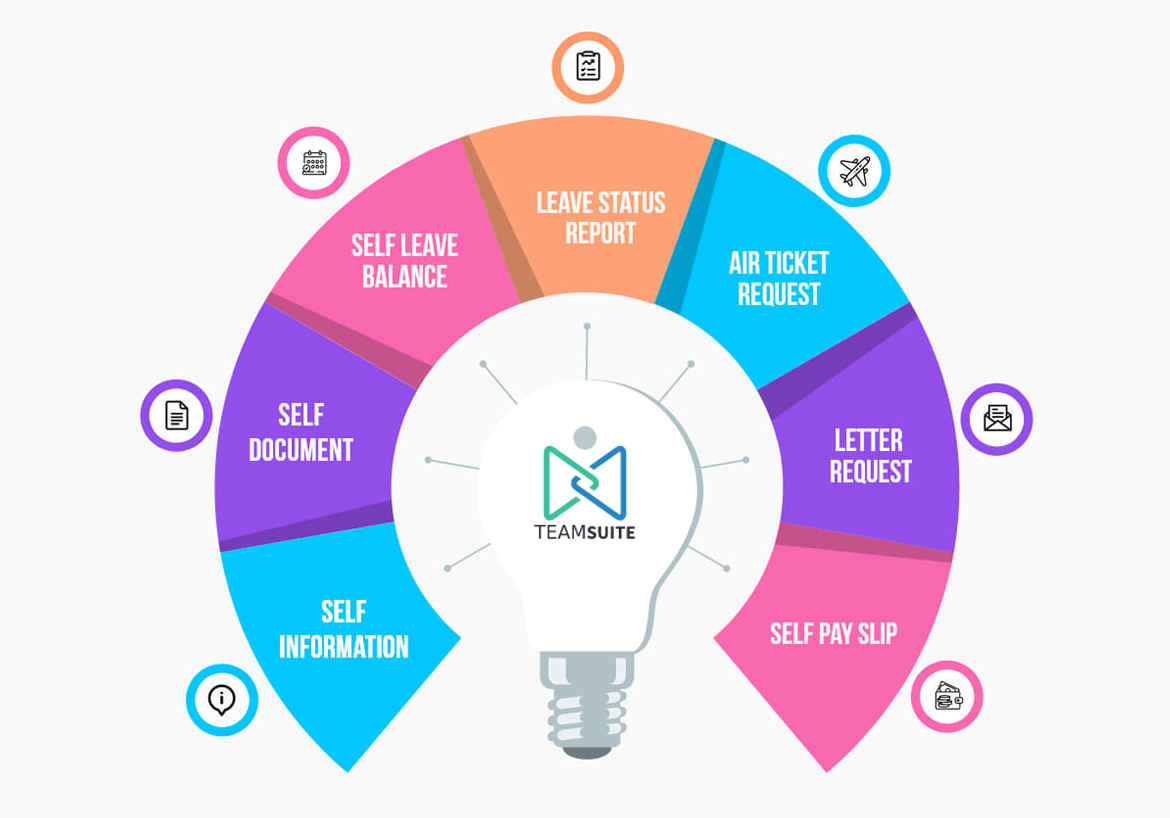

Payroll SoftwareAs discussed above, for running successful payroll, you need to ensure that payroll inputs are coming from every source in a timely and seamless manner. The intent of using software is to reduce the friction in getting the inputs. There are advanced payroll management software available in the market that not only automates payroll computation but also serve as a holistic leave and attendance management, HR management and employee self-service portal. Depending on the size of your business and use cases you can opt for an appropriate payroll software for your business.

Best Payroll Software for your Organization

The move from manual payroll system to automated one can save a lot of time. It not only helps in faster and accurate payroll processing but also keeps the employees, management and regulatory bodies happy.

There are some features that you should consider while selecting a payroll management software.

Ease of OperationPayroll function can be very cumbersome. You should opt for a system which has comprehensive but straightforward workflows. If the software is intuitive, it reduces the need for software training and guidance. Also, make sure that the software provider is providing well-updated documentation so that you can access the information anytime as you may need.

ScalabilityAs organization size increases your software also need to serve you appropriately. The limitation can be in terms of employees data it process or in terms of the availability of features like leave and attendance management, reimbursement model, etc. The software offerings should be such that you can opt for advanced features at a reasonable price without much difficulty.

Employee Self-Service ModuleOne of the primary payroll input providers is the employee. He provides information such as income tax saving investment declaration, type of flexible benefit opted, etc. The interaction between the payroll officer and employee is usually very event-based. To understand the significance of ESS module let’s assume a case of income tax declaration in two scenarios:

So, we saw how a simple tool like employee self-service portal can reduce the manual intervention and automate payroll data collection for accurate tax computation.

Integration with Time, Attendance and Leave Management System

Time ManagementTypically this module is used to track time spent on projects or specific activities. Consulting firms such as audit firms, specialist doctors, etc., who manage critical projects require a robust time management module for tracking time and at times this data may also be used for billing clients.

AttendanceWhile most small organization go for manual attendance system, medium and large organizations have started using smart automated tools such as biometric method, auto-tracking via system log-in, access cards, iris capture, etc. The data is stored in a system and linked to the payroll software that uses this data to calculate attendance days, overtime, etc. For seamless payroll processing, check that software supports attendance management and is configurable with access control machines.

Leave ManagementIn every organization, employees are entitled to take a certain number of leaves such as privilege or annual leave, casual leave, sick leave, holiday, etc. If the software has leave management feature, HR can directly credit these leaves to the account of every eligible employee. As and when required, the employee can apply for leave through the system. A good system should also be able to define a workflow to notify the employee’s manager for either approval or rejection. A robust payroll leave software with built-in leave management feature can help attain accurate payroll.

Integration with the Accounting SystemYour accounting/ERP system needs to record every financial transaction including payroll information like department wise employee cost, individual payroll components like reimbursements, tax due and paid, etc. Some payroll solution have integration with accounting software via API( a way to push data directly from one software to another). In the absence of such integration, the payroll officer needs to provide all transaction details to accounts department. The accountant then manually posts it in the form of journal entries in accounting/ERP software like Tally ERP, SAP, Quickbooks, etc. These integrations can help finance and payroll team work together and avoid any manual entry of data.

Cloud-Based Software over On-Premise Solutions

The payroll management automation space is transforming rapidly. The on-premise software solutions have become obsolete and businesses are going for cloud-based solutions due to their advantages.

Ability to Access the Data at Any Time and From AnywhereIf you use a cloud software, you do not need to be present in your office to be able to access your payroll data and employee data. You can login from anywhere at any time just like Gmail.

The Advantage over the Inherent Limitations of On-Premise SystemsThe on-premise systems have their limitations like threat of data loss by fire, flood, etc. Also, the setup cost of these systems is huge and comes with an initial operation limit. Often the annual maintenance cost is quite high. Whereas, the cloud solutions are built on such technology, so you can always opt for an upgraded plan that supports higher level of operations at any time. Since cloud solutions have data center at multiple locations, even during incidences of fire, flood, etc. your data remains safe.